Business Insurance in and around Virginia Beach

Virginia Beach! Look no further for small business insurance.

No funny business here

- Norfolk

- Chesapeake

- Portsmouth

- Moyock

- Suffolk

- Great Neck

- Little Neck

- Red Mill

- Thalia

- Alanton

- Green Run

- King's Grant

- Kempsville

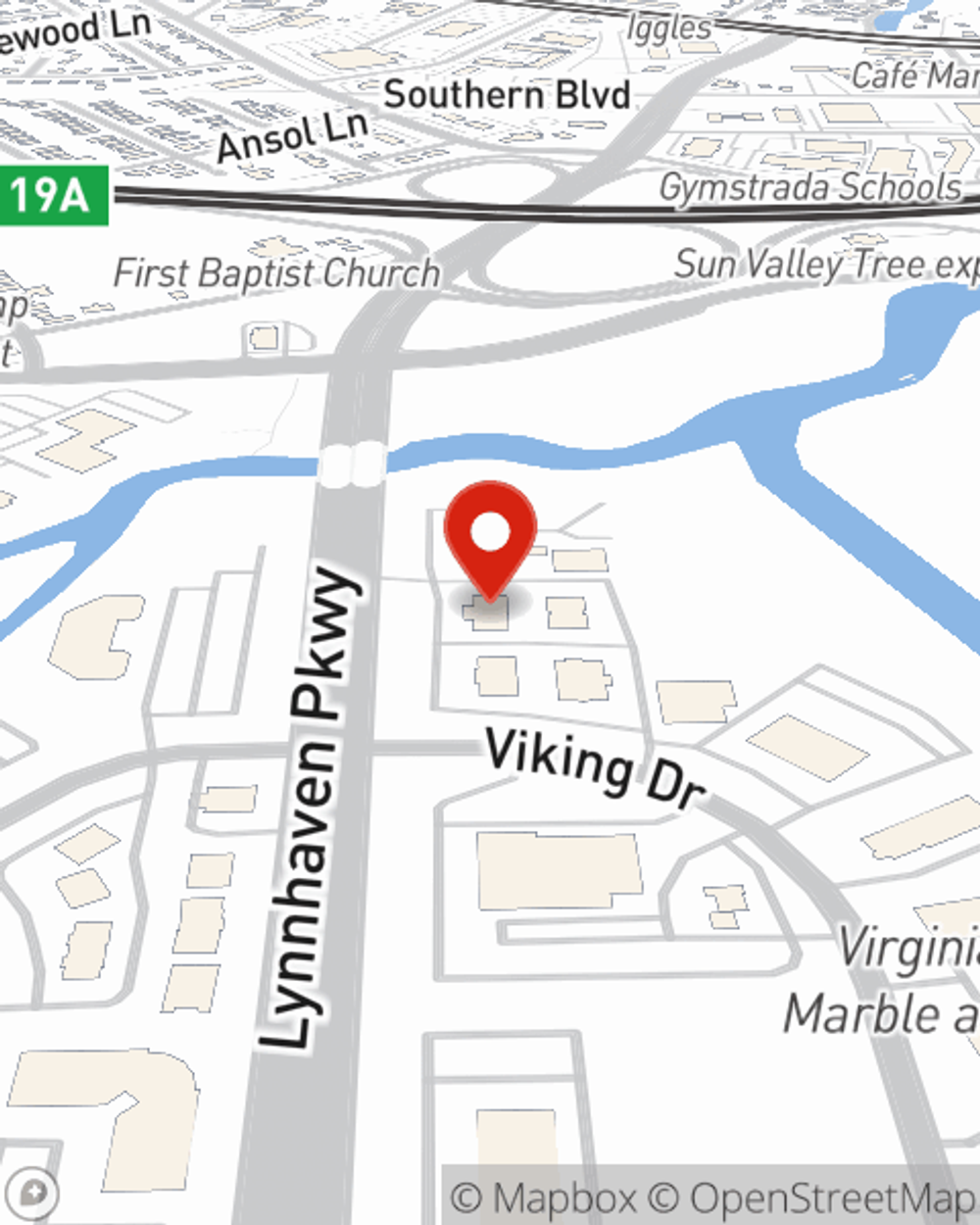

- Lynnhaven

- Thoroughgood

Help Prepare Your Business For The Unexpected.

Running a small business comes with a unique set of wins and losses. You shouldn't have to work through those alone. Aside from just those who care for you, let State Farm be part of your line of support through insurance options including errors and omissions liability, extra liability coverage and worker's compensation for your employees, among others.

Virginia Beach! Look no further for small business insurance.

No funny business here

Customizable Coverage For Your Business

At State Farm, apply for the fantastic coverage you may need for your business, whether it's a pizza parlor, a drug store or an ice cream store. Agent Aubrey Pithwa is also a business owner and understands what you need. Not only that, but customizable insurance options is another asset that sets State Farm apart. From one small business owner to another, see if this coverage can't be beat.

Agent Aubrey Pithwa is here to discuss your business insurance options with you. Visit with Aubrey Pithwa today!

Simple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Aubrey Pithwa

State Farm® Insurance AgentSimple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".